Accessibility Quick Links

Your credit card statement explained

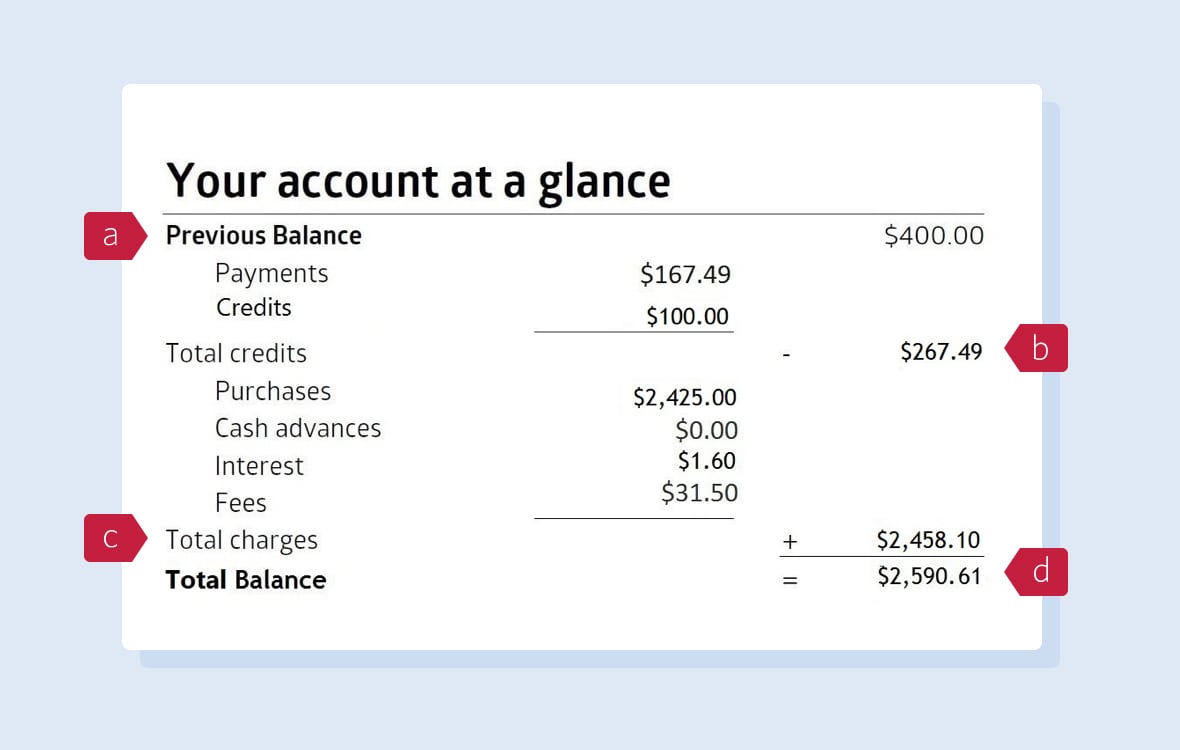

1. Your account at a glance

A summary of your transactions for this statement period.

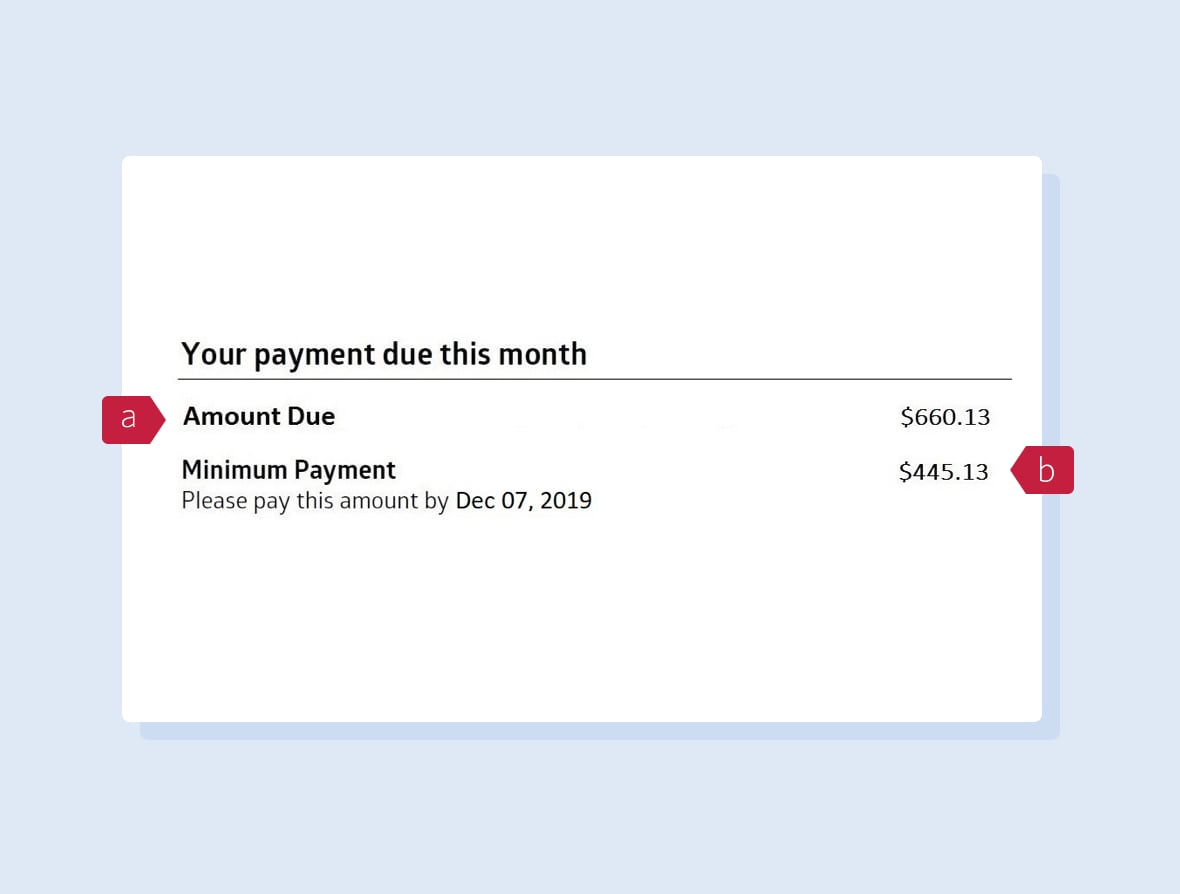

2. Your payment due this month

Pay either the amount due or minimum payment by the due date.

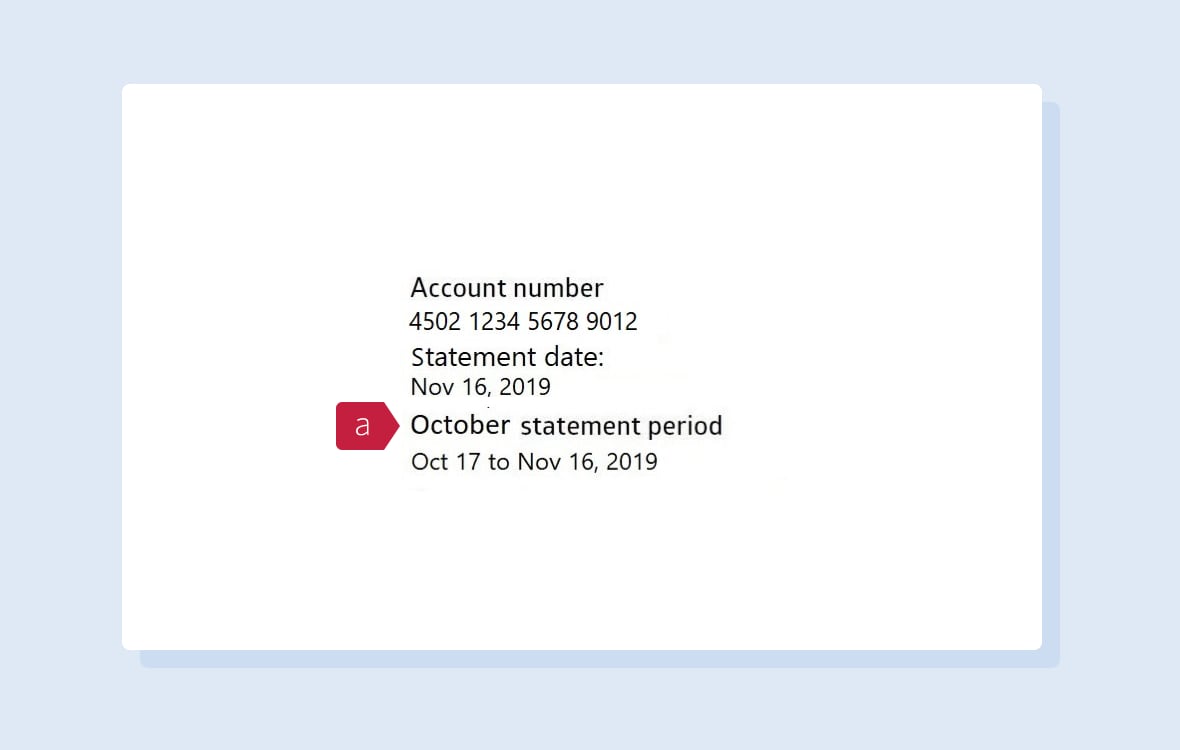

3. Statement period

The start and end dates of your credit card activity for this billing cycle.

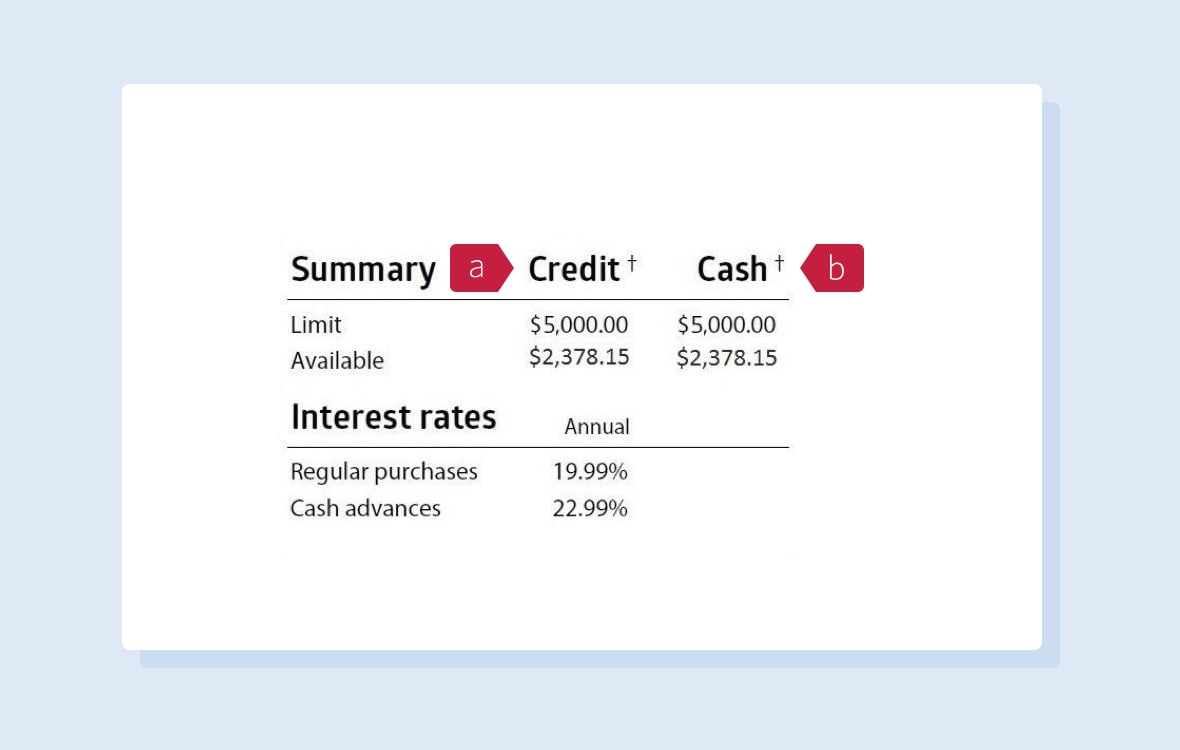

4. Credit and cash limits

How much money you can spend using your credit card.

5. Interest rates

The percentage you're charged on an unpaid balance, cash advance or balance transfer.

Searching for more credit card terms? Check out our glossary

Page 1 statement details

1. Your account at a glance

a) Previous balance is the total balance that appeared on your last credit card statement.

b) Any payments you made or credits posted to your account after your last statement period are subtracted from the money you owe.

c) Total charges is the total amount of your purchases, cash advances, interest and fees. Cash advances include balance transfers and convenience cheques.

d) Total balance is your total outstanding amount at the end of the statement period. If you pay this in full, you may also pay off any active CIBC Pace It™ Installment Plans you have. To calculate your total balance, we take your previous balance, subtract your credits and payments, and add your total charges.

2. Your payment due this month

a) Amount due is how much you need to pay to avoid interest on purchases shown on your statement that haven't been converted into an Installment Plan. The amount due includes any balance transfers and convenience cheques on your account, plus any monthly installment payments due if you have an Installment Plan.

To calculate your amount due, we take your total balance, subtract the current balance of any Installment Plans you have and add the monthly installment payments due. If you don't have any active Installment Plans, your total balance and amount due are the same, unless you have a credit balance. In that case, your amount due is $0.00.

b) Minimum payment is the lowest amount you need to pay by the due date to keep your account in good standing. It includes any monthly installment payments due. Your payment due date is shown in this section.

3. Statement period

a) Your statement period runs for one month and covers all your credit card activity during that time. The last day of the period is the date your statement was created. This is your statement date. Your payment is due at least 21 days after this date. You can find your due date in the "Your payment due this month" section.

4. Credit and cash limits

a) Your credit limit is the maximum amount you can charge to your card. Cash advances, balance transfers, convenience cheques and Installment Plans are part of your credit limit. The amount you have left to spend is your available credit.

b) Your cash limit is the maximum amount of cash you can withdraw or transfer from your card. It includes cash advances, balance transfers and convenience cheques. Your cash limit is part of your total credit limit — not extra money you can spend.

5. Interest rates

a) Interest rates are used to calculate the amount you're charged for borrowing money. It's shown on your statement as an annual rate.

b) Other than purchases converted into an Installment Plan, you can avoid paying interest on purchases shown on your statement if you pay the amount due by the due date.

c) For cash advances, interest is charged as soon as you make a cash advance or cash-like transaction.

For convenience cheques and balance transfers, interest is charged once they're posted to your account. If you have a promotional rate for a balance transfer, that rate will appear in this section. If you have an Installment Plan, you pay interest with each monthly installment payment, except for the first one. Find the interest rate for Installment Plans on the second page.

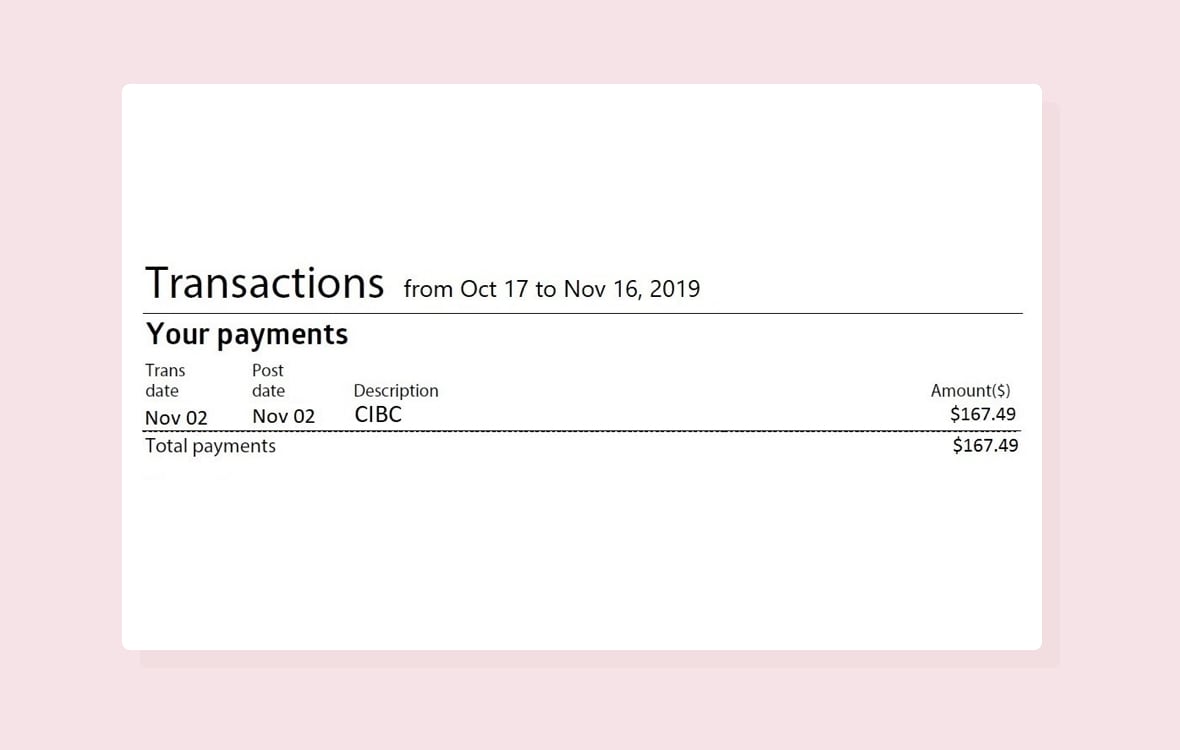

6. Your payments

What you paid during the statement period.

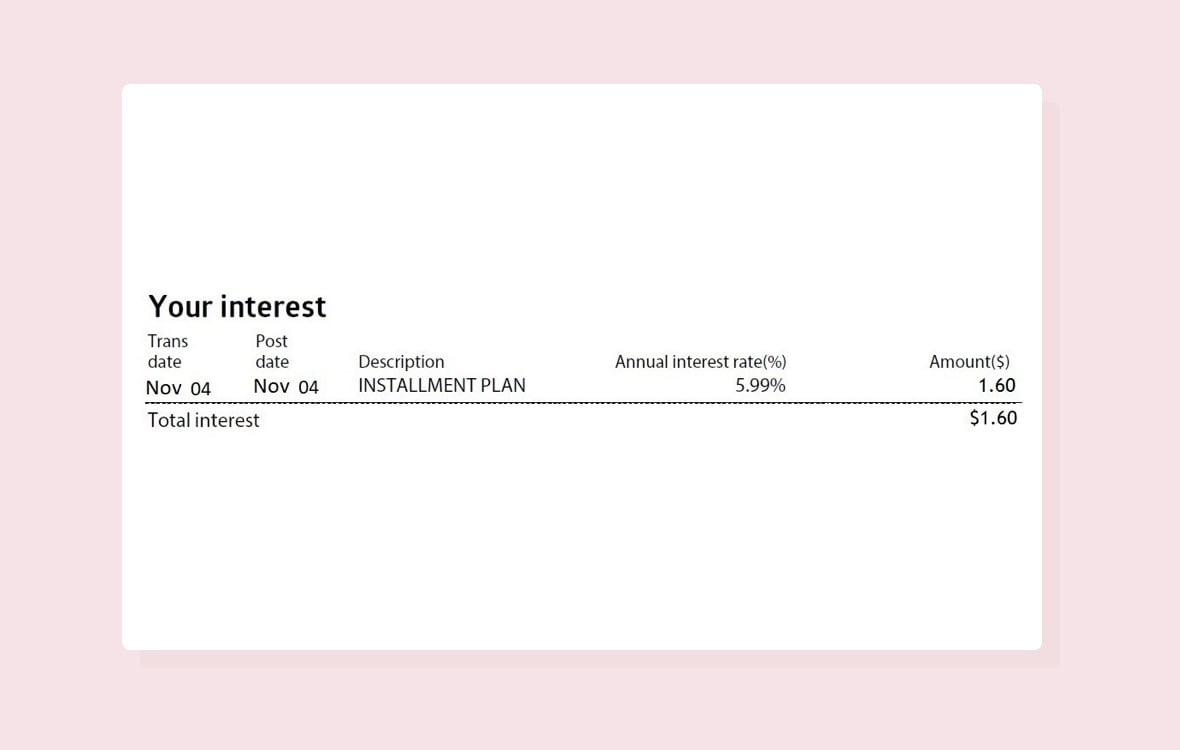

7. Your interest

The interest you're charged during the statement period.

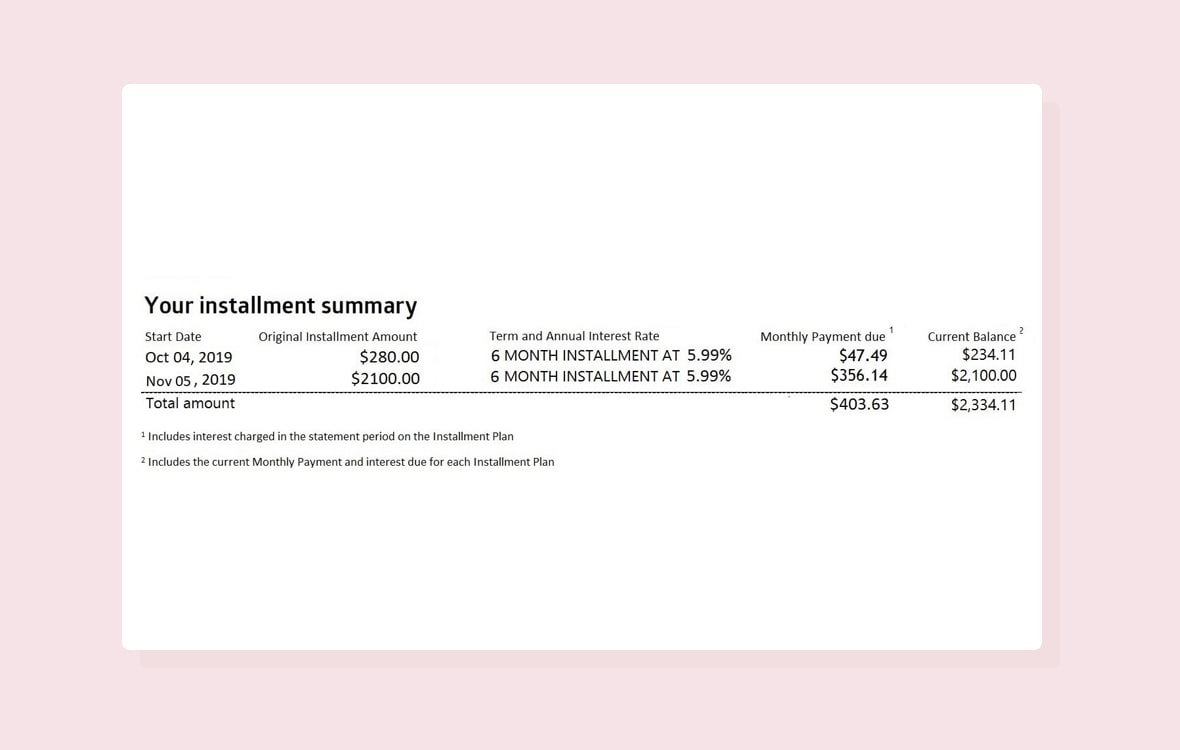

8. Your installment summary

Details of any CIBC Pace It Installment Plans that are active on your account.

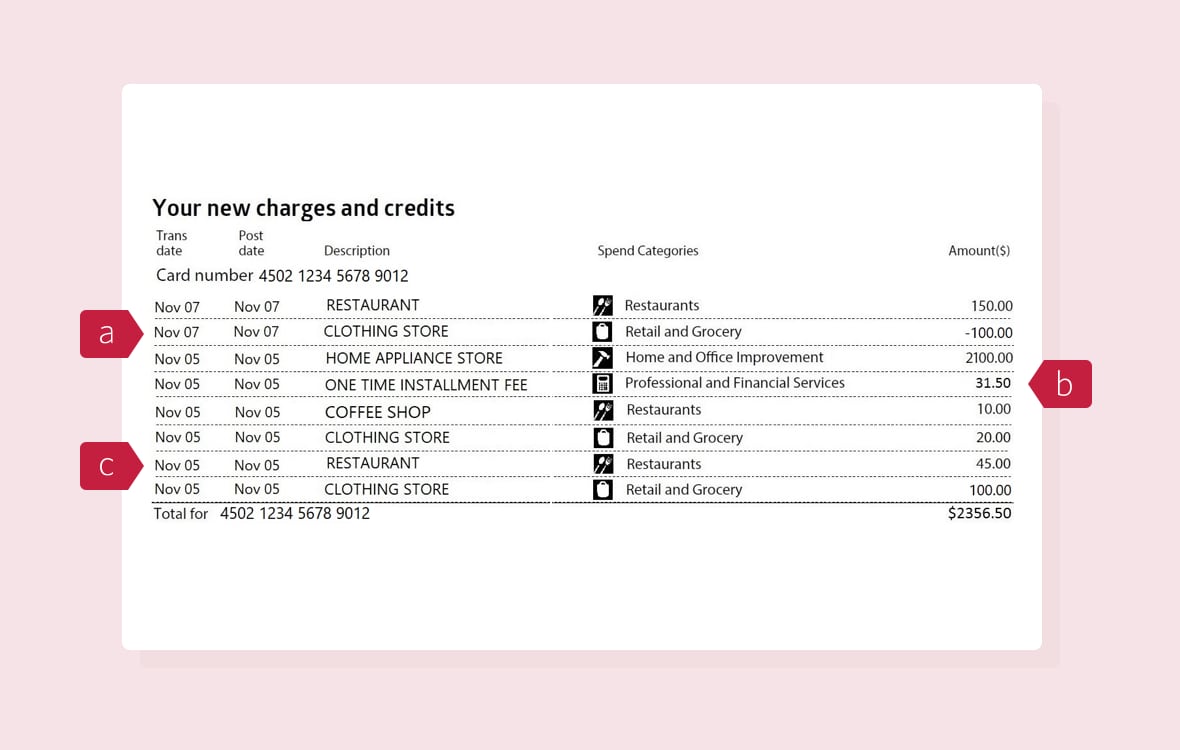

9. Your new charges and credits

All your charges, such as purchases and fees, and credits posted to your account during the statement period.

Searching for more credit card terms? Check out our glossary

Page 2 statement details

6. Your payments

If you're worried about missing a payment, you can set up alerts to remind you.

Or you can sign up for CIBC Auto Pay Service. It withdraws your payment automatically from your bank account on the due date. You can choose to pay the minimum payment or the amount due each month. To set up Auto Pay, visit a CIBC Banking Centre or call 1-800-465-4653Opens your phone app..

7. Your interest

When you don't pay your amount due by the due date, you're charged interest on the money you still owe. You'll continue to pay interest until you pay off the total balance. This section includes any interest from purchases, cash advances, balance transfers, convenience cheques and CIBC Pace It Installment Plans. It also lists the annual interest rate for each charge. For each active Installment Plan you have, the interest you pay with your monthly installment payment is listed in a separate line.

8. Your installment summary

CIBC Pace It is an Installment Plan that lets you pay off big purchases in monthly payments at a lower interest rate. This can help you pay for the big things that matter at a pace you choose. This section shows the original purchase amount, length of the plan, annual interest rate, installment payment due this month and how much you have left to pay on your plan. After the first payment, each monthly installment payment includes both the interest and the Installment Plan principal.

9. Your new charges and credits

a) When you get money back on your account, such as a refund, this amount appears as a credit. It's subtracted from the amount you owe.

b) The One Time Installment Fee is the amount you pay when setting up your CIBC Pace It Installment Plan. The fee is 1.50% of the purchase amount.

c) Other types of charges include purchases, balance transfers, convenience cheques, cash advances and other fees. If you have the optional CIBC Payment Protector™ Insurance, this section will show the premium due for the statement period. Setting up an Installment Plan won't change how your premiums are calculated.

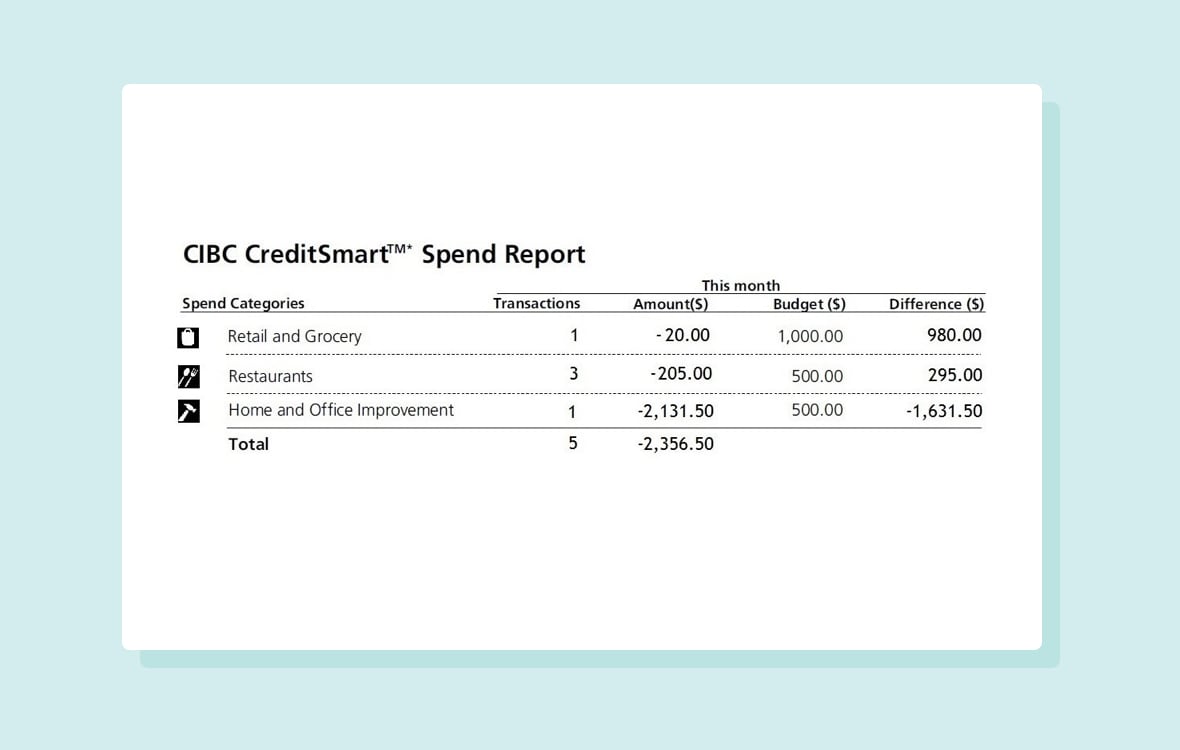

10. CREDITSMART® SPEND REPORT

A summary of where you've used your credit card.

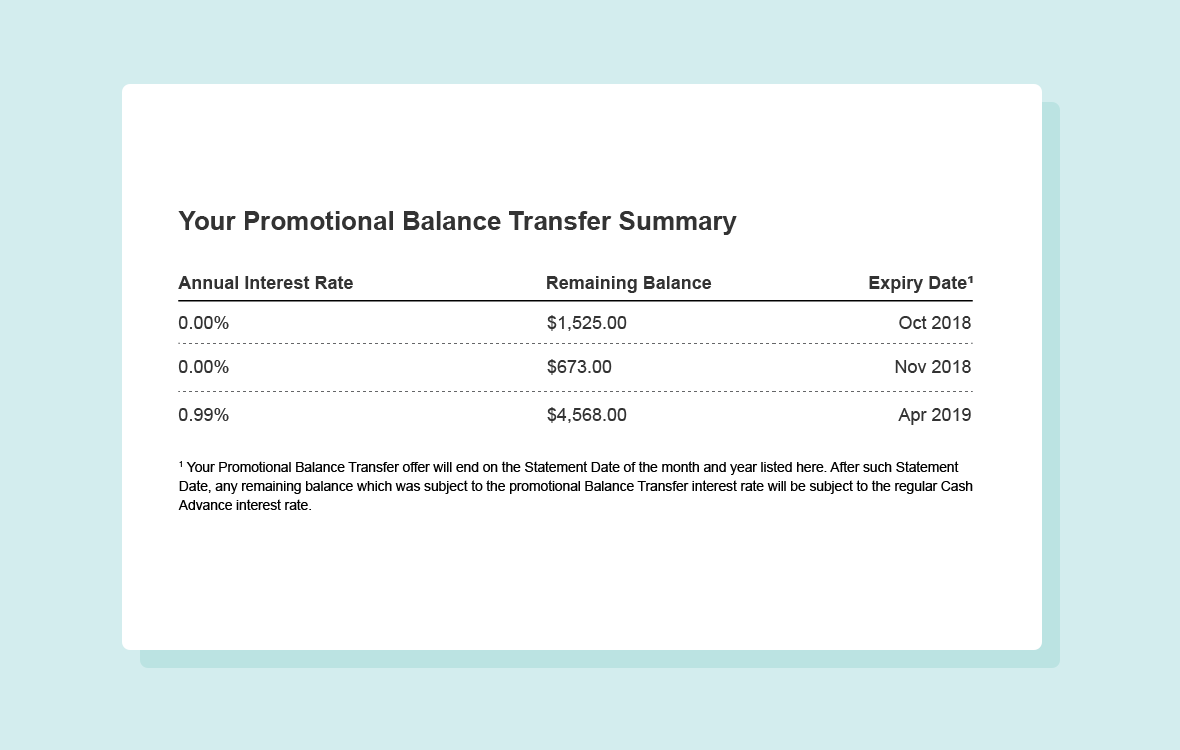

11. YOUR PROMOTIONAL BALANCE TRANSFER SUMMARY

A summary of active promotional balance transfers on your credit card account.

12. YOUR MESSAGE CENTRE

Important messages from us about your account.

Searching for more credit card terms? Check out our glossary

Page 3 statement details

10. CreditSmart Spend Report

CreditSmart Spend Report helps you track your spending. This section sorts your transactions into 10 categories and shows how much you've spent in each one. If you've set a monthly budget for each category, you can tell at a glance if your spending is on target. To set up budgets, sign on to your CIBC Online Banking account. You can also set up alerts to notify you when you go over your budget.

11. YOUR PROMOTIONAL BALANCE TRANSFER SUMMARY

CIBC promotional balance transfer offer is a promotion whereby CIBC offers clients a lower balance transfer annual interest rate on balance transfers made on their credit card account which may or may not include a fixed one-time balance transfer fee. This section shows the promotional interest rate for balance transfers performed as a result of a special offer made by CIBC, the remaining outstanding balance for the promotional balance transfers performed and the expiry date of the promotional balance transfer. As per the promotional balance transfer offer terms and conditions, after the expiry date, the annual interest rate applicable to the balance transfer balance will revert to cash advance annual interest rate applicable to your credit card account. This summary only shows active promotional balance transfers on your credit card account.

Learn more about credit cards

How to switch to eStatements

Access up to 7 years of your credit card statements online and on your mobile device.

How your credit limit is determined

Find out what factors go into deciding how much you can spend on your card.

Credit score basics

A strong credit score is important if you want to borrow money for a big purchase or increase your credit limit.

Need to talk?

Get in touch. We're here to help