Reach your goals sooner

Making investing a consistent priority is one of the most reliable ways to grow your wealth.

It can be challenging to strike a balance between your goals for today and your goals for some day. Here are a few investing best practices to keep in mind while you build your investment portfolio.

Start early

The sooner you can start investing, the longer your money can grow. And the longer you’re invested, the more you can reap the rewards of compound interest.

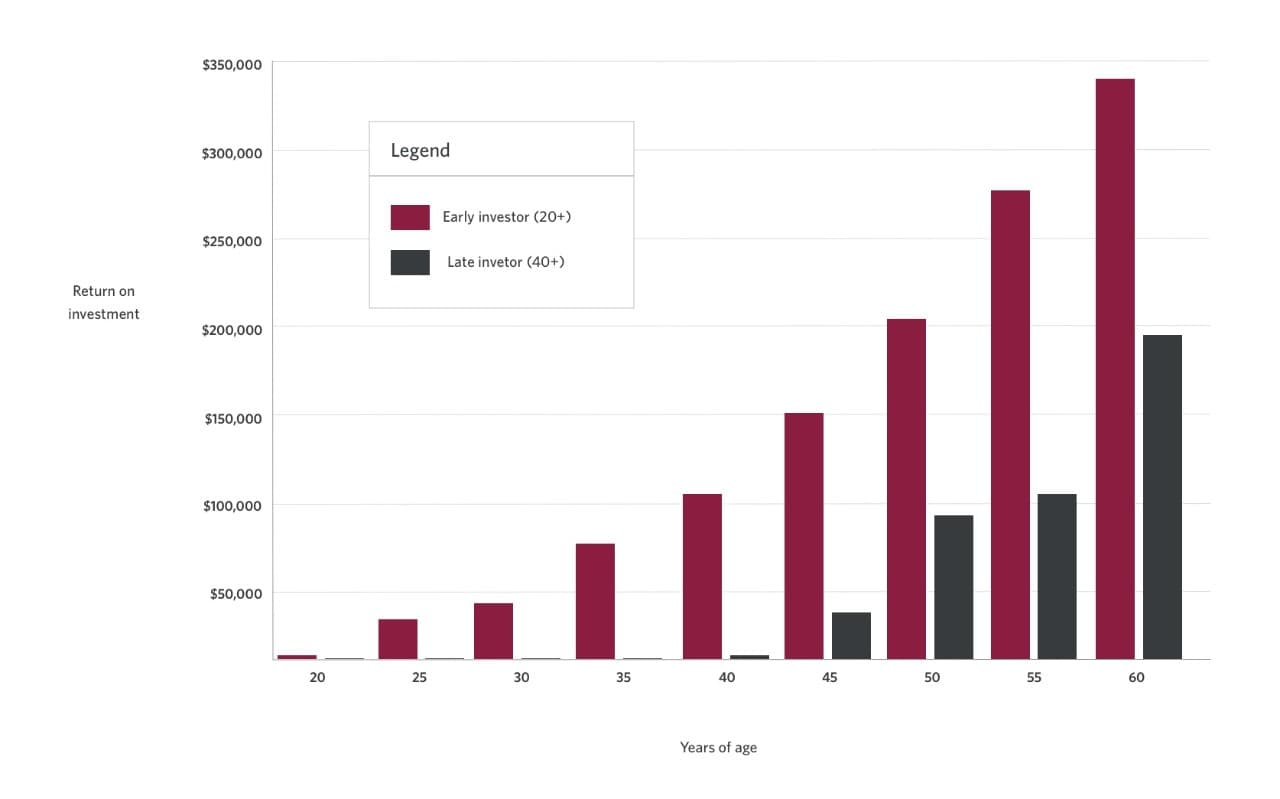

Investing for retirement: Early investor vs. late investor1

| Years of age | Return on investment for early investors (20 and over) | Return on investment for late investors (40 and over) |

|---|---|---|

| 20 | $2,465 | $0 |

| 25 | $16,763 | $0 |

| 30 | $35,013 | $0 |

| 35 | $58,304 | $0 |

| 40 | $88,031 | $4,929 |

| 45 | $125,970 | $33,527 |

| 50 | $174,391 | $70,026 |

| 55 | $236,190 | $116,609 |

| 60 | $315,063 | $176,061 |

Make it a habit

Investing regularly, such as through an automatic savings plan, can help you stay on track over the long term.

Regular investments table2

| Investment amount by duration | $50 per month | $100 per month | $250 per month | $500 per month |

|---|---|---|---|---|

| Invested for 5 years | $3,405 | $6,809 | $17,023 | $34,045 |

| Invested for 10 years | $7,750 | $15,499 | $38,748 | $77,496 |

| Invested for 15 years | $13,295 | $26,590 | $66,476 | $132,952 |

| Invested for 20 years | $20,373 | $40,746 | $101,864 | $203,729 |

| Invested for 25 years | $29,406 | $58,812 | $147,030 | $294,060 |

Invest enough

The question isn’t, “how much should I invest?” It’s, “what am I saving for?” Having a clear picture of your long-term goals and understanding the costs associated are key steps in your investment planning. Your advisor can help you determine if you’re investing the right amount by working through questions like these:

- What is your savings goal? (Buying a cottage, retirement, travel, etc.)

- How much do you need to save to attain this goal?

- What savings have you already made towards this goal?

- When do you want to achieve your goal by?