◊◊ No purchase necessary. Open January 1, 2021 to December 31, 2021 to legal residents of Canada who are 16 years of age or older and are current students of an accredited Canadian university, college or secondary school. One Grand Prize available to be won consisting of:

- One cheque for $8,750 made payable to the winner;

- One 1-year GIC for $8,750 opened in the winner’s name;

- One 2-year GIC for $8,750 opened in the winner’s name; and

- One 3-year GIC for $8,750 opened in the winner’s name.

Odds of winning depend on number of eligible entries received. Math skill test required. Refer to the full contest rules (PDF, 145 KB) Opens in a new window..

Winner will be picked January 10, 2022. Check full rules for other ways to enter.

† To be eligible for a free SPC membership, you must hold an eligible CIBC product at the time you register for the membership, which you must do through CIBC online or mobile banking. Eligible CIBC products include a CIBC Youth or Student bank account, Student credit card or Student line of credit. A complete list of eligible CIBC products can be found at SPC and CIBC. Joint account holders of eligible CIBC products are not eligible for membership. You must also be a legal resident of Canada who is fourteen (14) years of age or over, but under the age of thirty (30) years if the eligible CIBC product you use to qualify for the membership is a student line of credit. The membership will automatically renew and remain in effect for as long as you hold an eligible CIBC product.

Trade-mark/registered trade-mark of Student Price Card Ltd.

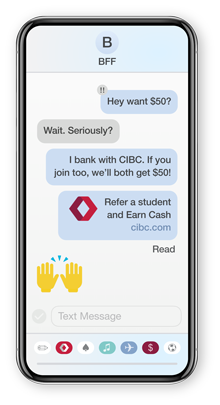

‡ CIBC Refer-a-Friend $75 Reward Offer (the “Offer”) is part of the CIBC Refer-a-Friend (Newcomer, Student, Youth) program (the “Program”). Offer begins on March 27, 2025 at 12:01 am (ET) and ends on June 30, 2025 at 11:59 pm (ET) (the “Offer Period”). To be eligible as a referrer (a “Referrer”), individuals must: (i) be residents of Canada, (ii) have reached the age of majority in their province and territory of residence, (iii) hold a CIBC Canadian dollar chequing or savings account that is open, active and in good standing, and (iv) have registered for CIBC mobile or online banking. To be eligible as a friend (a “Friend”), an individual must: (i) from November 1, 2018 to the time of account open, not be a holder (or joint holder) of a CIBC Smart Account as determined by CIBC on the basis of its official records, (ii) have a personal or family relationship with the Referrer, and (iii) meet the eligibility requirements to open a CIBC Smart Account with CIBC Smart for Newcomers, CIBC Smart for Foreign Worker, CIBC Smart for Student or CIBC Smart Start benefits (the “Account”). To qualify to receive a $75 referral reward (the “Reward”), a Referrer must refer a Friend and the Friend must open the Account during the Offer Period and complete all qualifying actions in accordance with the CIBC Refer-a-Friend Program Terms (PDF, 110 KB) Opens in a new window. Limit of one (1) Reward payable to a Referrer per qualifying Friend and one (1) Reward payable to a qualifying Friend, regardless of how many CIBC Smart accounts are opened by the Friend. Referrer may receive up to fifty (50) Rewards per calendar year. Referrals containing the “Refer and Earn” link must be created and distributed in a personal manner that is appropriate and customary for communications with friends and family members and must not appear to be sent by or on behalf of CIBC. Bulk email distribution, distribution to strangers, or individuals with whom the Referrer does not have a personal or family relationship may be grounds for immediate termination from the referral program, revocation of Rewards and further legal action by CIBC. CIBC reserves the right to end, cancel, change or suspend this Offer or the Program, or change these terms for any reason without notice. Other conditions apply. To learn more, refer to the Refer-a-Friend Program Terms and Conditions (PDF, 110 KB). Opens in a new window.

1 A transaction includes cheques, withdrawals, transfers, pre-authorized payments, bill payments (including CIBC Credit Cards and CIBC Personal Lines of Credit) and debit purchases. For CIBC eAdvantage Savings Accounts, a transaction does not include transfers to your other CIBC bank account(s) using the transfer function on CIBC Online Banking, CIBC Mobile Banking, CIBC Telephone Banking and at CIBC ATMs. For all accounts, transfers to CIBC-branded loans (excluding CIBC Personal Lines of Credit), mortgages and investments (registered and non-registered) are free. "CIBC-branded” means any brand that has CIBC in its name and is offered by CIBC or its Canadian affiliates (and does not include CIBC Bank USA). Other fees (in addition to any transaction fee) include: withdrawals from non-CIBC bank machines (rebated for CIBC Smart Plus Accounts except the 2.5% administration fee on the converted amount of foreign currency ATM withdrawals), wire payments, Interac e-Transfer transactions (the Interac e-Transfer fee is waived for CIBC Smart Accounts, CIBC Smart Plus Accounts and for clients who are enrolled in CIBC Advantage for Youth, CIBC Smart for Students, CIBC Smart for Seniors (on the CIBC Smart Account) and CIBC Advantage for Students (on the CIBC Everyday Chequing Account)) and transactions in foreign currency (including cheques written in currencies other than the account currency).

2 Until graduation date plus an additional 6 months, up to a maximum of 4½ years in total. Regular Smart Account fees will apply thereafter.

Trademarks