Accessibility Quick Links

CIBC ranked #1 for Small Business Banking Customer Satisfaction by J.D. Power5 2 years in a row.

Get financing and grow your business at any stage

Enjoy personalized service

Our business banking experts can connect with you on your schedule and in your community.

Take advantage of expert advice

Explore practical how-to guides, financial tips and insights from business owners like you with Smart Advice for Business.

Borrow for your business needs

Apply for your business loan, line of credit, overdraft protection or the Canada Small Business Financing Program to help your business succeed.

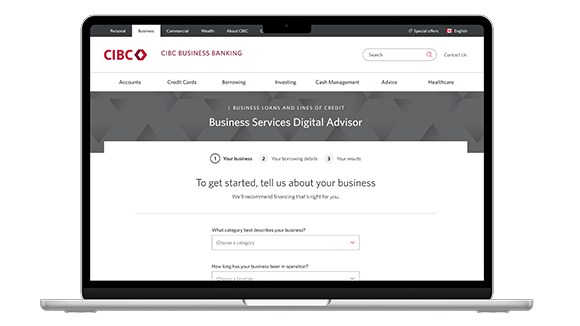

Business Services Digital Advisor

Business lines of credit

Cover day-to-day operating expenses

Business overdraft

Protect your business from unexpected cash shortfalls

CANADA SMALL BUSINESS FINANCING PROGRAM

Get support for your small business

Ready to get started? We're here to help.

How can I apply?

Step 1

Book a meeting

Meet with one of our business advisors who will guide you through the application process and answer any questions. They can also help review your finances and give tailored advice based on your borrowing needs. Find an advisor Opens in a new window..

Step 2

Get a decision

We'll verify your information and review your credit profile. If your application meets our borrowing criteria, you'll get approved for a specific borrowing amount, interest rate and repayment term.

Step 3

Receive funds

After you accept your offer and sign a few documents, you can start using your money directly from your business bank account. Get funds in as little as 2 days for most applications.1

What documents do I need?

When you book a meeting with your business advisor, they’ll request that you bring a few documents to support your credit application, such as:

- Financial statements for the last 2 years of business

- Recent business and personal tax returns

- A business plan, if your business is new or starting up

- Two pieces of valid photo ID

- Any other documents your advisor may request for due diligence

For a full list of recommended documents, review our business credit application document checklist (PDF, 160 KB) Opens in a new window..

Is my business eligible?

Your business may be eligible for financing if you can demonstrate any of the following:

- You have industry experience

- Your business is located and operates in Canada

- Your business generates positive cash flow, meaning your inflows have exceeded your outflows, for at least 12 to 24 months

- You have a good credit score

Tips for getting approved

You can increase your chances of your credit application getting approved in several ways:

- Prove your business can repay the debt

- Have a good credit score

- Show proof of valuable assets to secure funds

- Provide a list of guarantors who can pay back your debt in the event you can't

Looking for something else? We've got more borrowing options.

Agriculture loans and lines of credit

Manage operating costs, buy new equipment and grow your farm business. Choose from flexible loans or lines of credit tailored to your unique needs.2

Banking for Black-owned businesses

Apply for up to $250,0003 in financing and take advantage of exclusive banking offers to build your business on a solid foundation.

Franchise financing

Get the financial help you need to meet your franchise and personal goals. Talk to our experts and borrow up to $1 million.4