The CIBC Bank USA Smart Account is offered and supported in English only. The CIBC Bank USA Smart Account is a non-interest bearing chequing account. All transactions are in US dollars only.

The CIBC Bank USA Smart Account is available to CIBC clients with an eligible CIBC (Canada) deposit account who are Canadian or US residents and are over 18 years of age.

Fees may apply to debit card transactions at ATMs not owned by CIBC or CIBC Bank USA.

The CIBC Bank USA Smart Account is offered by CIBC Bank USA. CIBC Bank USA is a wholly-owned subsidiary of CIBC. Deposits in the CIBC Bank USA Smart Account are insured up to the applicable limits by the Federal Deposit Insurance Corporation (FDIC). CIBC and its employees are not agents or employees of CIBC Bank USA. Please contact CIBC Bank USA for account servicing questions.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

† You can qualify for this offer if you apply and are approved for a new U.S. Dollar Aventura® Gold Visa* card beginning March 5, 2024.

The $25 value is based on the redemption value for 2,500 Aventura Points towards a Flexible Travel Reward purchase at a rate of 100 points = $1.00 CAD

If you apply and are approved for a new U.S. Dollar Aventura® Gold Visa* , you can receive up to 2,500 Aventura Points:

a) Up to 2,500 bonus Aventura Points for completing the below activities within 60 days of your CIBC Aventura® Visa* account approval. The following activities are worth 500 Aventura Points each: 1. Share your email address with CIBC; 2. Sign up for eStatements for your new Aventura Visa card; 3. Add an authorized user on your new Aventura Visa card; 4. Hold any eligible CIBC Chequing Account; and 5. Add your Aventura Visa card with Apple Pay® or Samsung Pay or Google Pay™. It may take up to two statement cycles for the bonus Aventura Points to appear on your credit card statement after each of the above activities have been completed. You can provide us with your email address and sign up for eStatements through CIBC Online Banking, by visiting a branch or calling 1-800-465-4653 Opens your phone app.. This offer is applicable to the first authorized user added only. Your authorized users will be issued the additional card(s) automatically when we get your request, as long as your credit card account is: a) still in good standing at that time, and b) your request does not exceed a total of 3 authorized users (counting any existing authorized users you may already have). Authorized users under the age of 13 can only be added by calling CIBC at 1-800-465-4653 Opens your phone app.. You must hold any of the following CIBC Chequing accounts: CIBC Everyday® Chequing Account, CIBC Smart™ Account, CIBC SmartPlus® Account, CIBC US$ Personal Account, CIBC Personal Chequing Account, CIBC EverydayPlus® Chequing Account, CIBC Waive Account®, CIBC MenuPlus® – Maximize Interest Account, CIBC Chequing Savings Account. If you already have an existing eligible CIBC Chequing account or shared your email address with CIBC, you will be qualified to receive the 500 Aventura Points each. If you do not have an eligible account you may apply online or by calling 1-866-525-8622 Opens your phone app.. To learn more about the mobile payment options, visit cibc.com.

A one-time annual fee rebate for you (the primary cardholder). This offer applies for the first year only. If you qualify, the rebate will be awarded to you and will appear as a credit against the applicable annual fee(s) within two statements. Your new credit card account must be open and in good standing at the time the rebate is awarded.

Offer applies to newly approved card accounts only; transfers from an existing CIBC credit card to a U.S. Dollar Aventura® Gold Visa* Card are excluded. Card account must be open and in good standing at the time the Aventura Points are awarded. Aventura Points are awarded to you within 8 weeks after all qualifying purchase(s) are posted to your account. The following do not qualify as purchases: cash advances, balance transfers, CIBC Convenience Cheques, fees, interest, Aventura Points redemptions and payments. It may take up to several business days for purchases to be posted to your account. This offer is not transferable. This offer may be withdrawn or changed without prior notice at any time. CIBC may approve your application, but you are not eligible to receive this Offer if you have opened, transferred or cancelled another Aventura card within the last 12 months. This offer may be revoked if you appear to be manipulating or abusing it, or are engaged in any suspicious or fraudulent activity, as determined by CIBC in its sole discretion.

1 If you transfer funds between your CIBC Canadian dollar account and your CIBC Bank USA Smart Account, CIBC exchange rate conversion fees will apply. If you transfer funds between your CIBC US$ Personal Account and your CIBC Bank USA Smart Account, no exchange rate conversion fees will apply.

2 ATM transactions may be conducted through the MasterCard®, Cirrus®, STAR®, NYCE and Maestro® networks. CIBC Bank USA will not charge you a fee for using other banks’ ATMs, but the owner or operator of a non-CIBC Bank USA ATM may charge a fee to use the ATM.

3 Transactions include ATM or pre-authorized withdrawals, Zelle® payments, online payments or transfers, mobile remote deposit, point of sale purchases and teller assisted transactions. For up to four withdrawals from non-CIBC or non-CIBC Bank USA ATMs, you’ll receive a refund each month, up to $20.

4 Enrolled users are allowed to send and receive money with Zelle® even if they bank with another bank besides CIBC Bank USA. Transactions between enrolled consumers typically occur in minutes. Data rates may apply.

5 Regular interest is calculated daily at the current rate on each day’s full closing balance and paid on the last business day of the month. Your entire account balance earns the rate applicable to the tier when the final balance falls in any of the first 4 tiers. On the final tier, the rate applies only on the portion of the balance in that tier. This interest cannot be withdrawn, and will not be printed at branch terminals or bank machines or made available through CIBC Telephone or Online Banking, until the second business day of the following month.

Interest rates quoted are annual. Interest rates and balance tiers are subject to change without prior notice.

If you have any questions about our interest rates, call 1-800-465-2422 Opens your phone app., or come into your local CIBC Banking Centre Opens in a new window. today to open an account.

6 Aventura Points are earned on card purchases less returns, and not on cash advances, interest, fees, balance transfers, payments, regular CIBC Convenience Cheques or Aventura Points redemptions. Aventura Rewards and Program Terms may change without notice. Taxes, fees and other charges may apply to Rewards. Aventura Points earned on purchases during a monthly statement period may not be credited to you if your card is not in good standing at any time during the monthly statement period.

7 CIBC foreign exchange rates apply if you make non-USD payments on your credit card account. Transactions (debits and credits) not in the currency of your card are converted into the currency of your card no later than the transaction posting date, at an exchange rate that is 2.5% over the rate CIBC must pay. Any purchases made outside the U.S. are also posted to your account and appear on your statement in U.S. dollars (USD). Currency exchange fees will apply to any purchases that are not in USD.

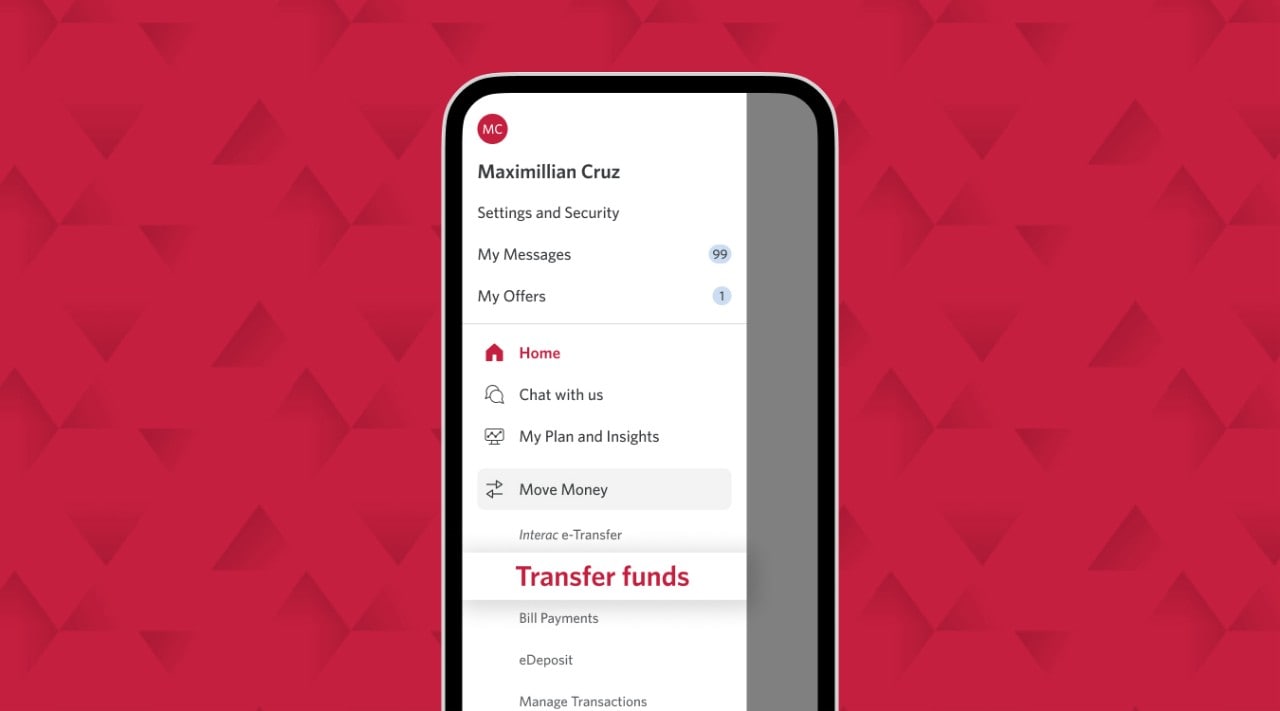

8 You can transfer funds in real time from your Canadian dollar to US dollar accounts using CIBC online or mobile banking. Do all your everyday US banking such as bill payments with CIBC NetBanking.