Accessibility Quick Links

How To

How to

It’s great when clients ask questions, even if they aren’t sure what to ask. The best thing to do is communicate.

Sep. 06, 2023

Enter the answer that will quell all of your fears: a business loan.

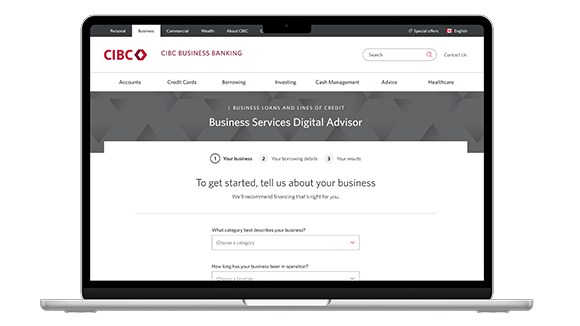

Business Services Digital Advisor

What to expect when applying for your first business loan

What documents and paperwork do I need to bring when meeting with an advisor?

Is there more than one type of business loan?

What are the pros and cons of having a business loan?

Should business loans be kept separate from personal loans?

Next steps

Here’s how CIBC can help