What are marketing preferences?

How do I manage my CIBC marketing preferences?

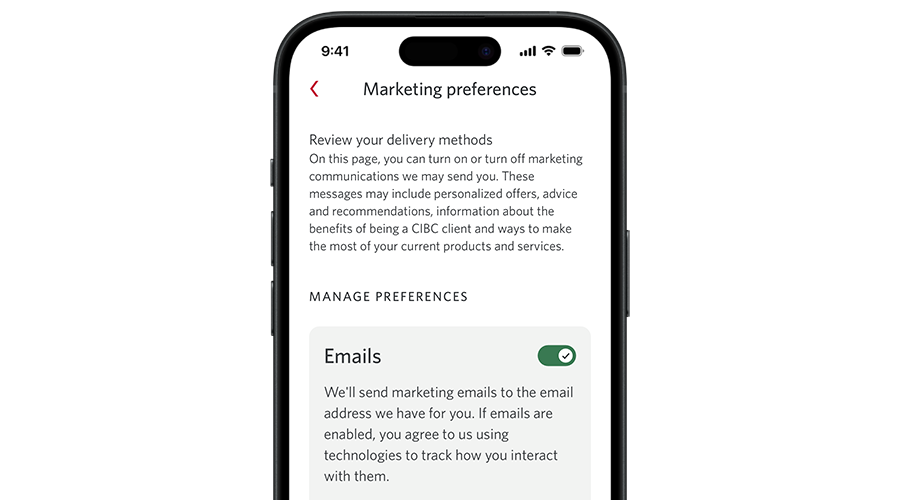

Manage your preferences through mobile banking

Make sure you have the latest version of the app downloaded for the best mobile banking experience.

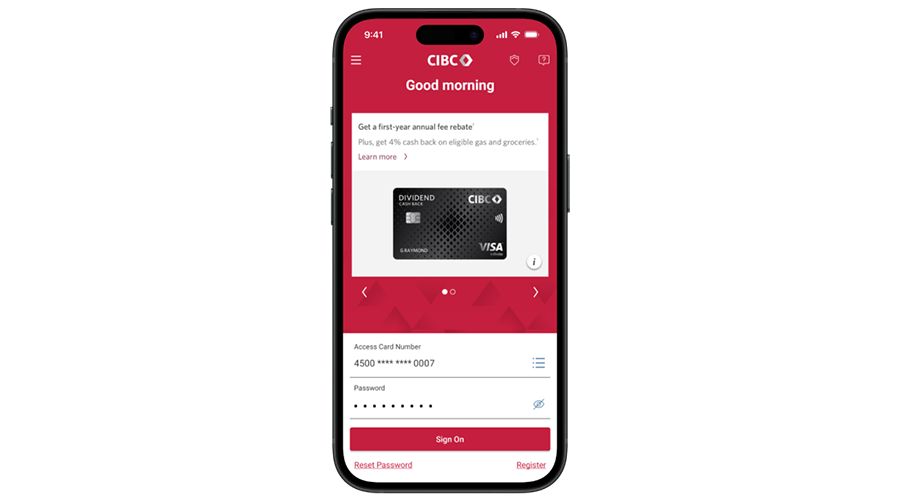

Step 1

Sign on to the mobile banking app.

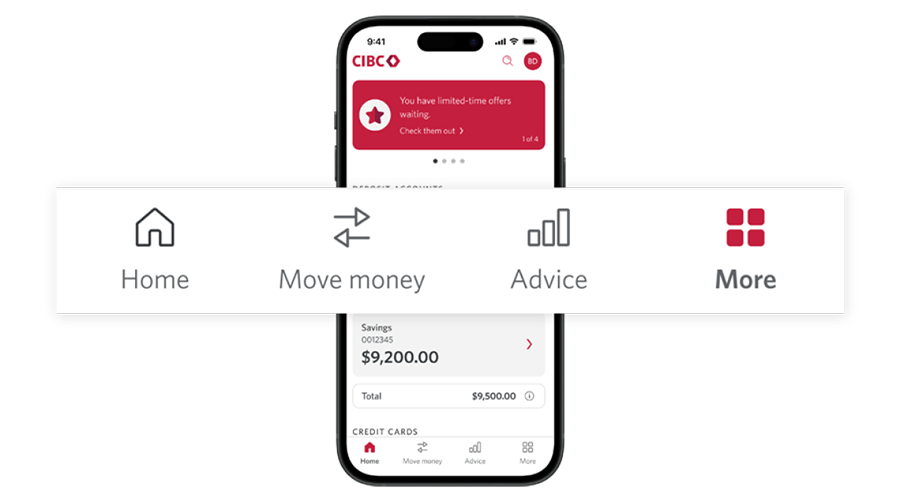

Step 2

Select “More” from the bottom menu.

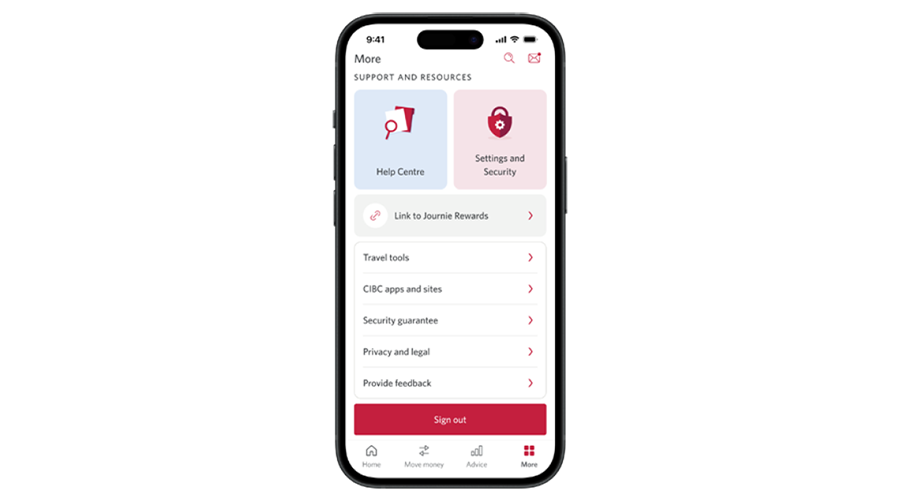

Step 3

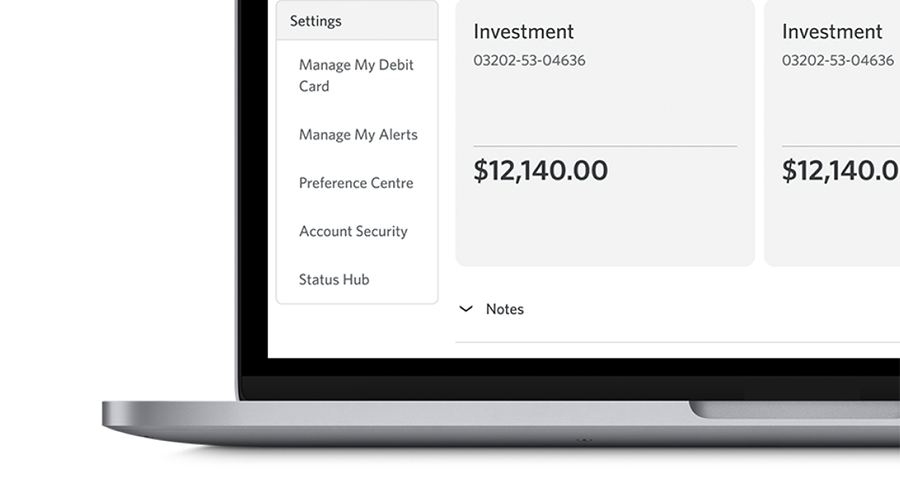

Select “Settings and Security.”

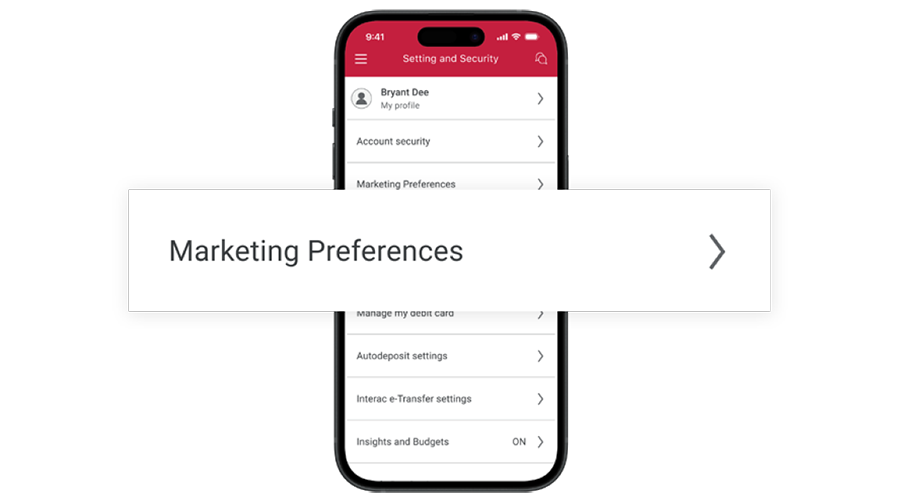

Step 4

Select “Marketing Preferences.”

Step 5

Review the different types of marketing communications and delivery methods and select the options you’d like to turn on or turn off.

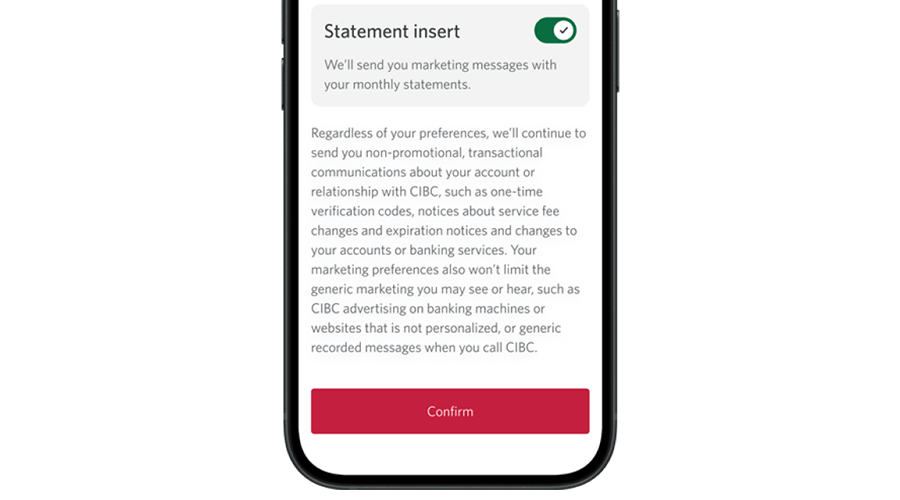

Step 6

Select “Confirm” to save your choices.

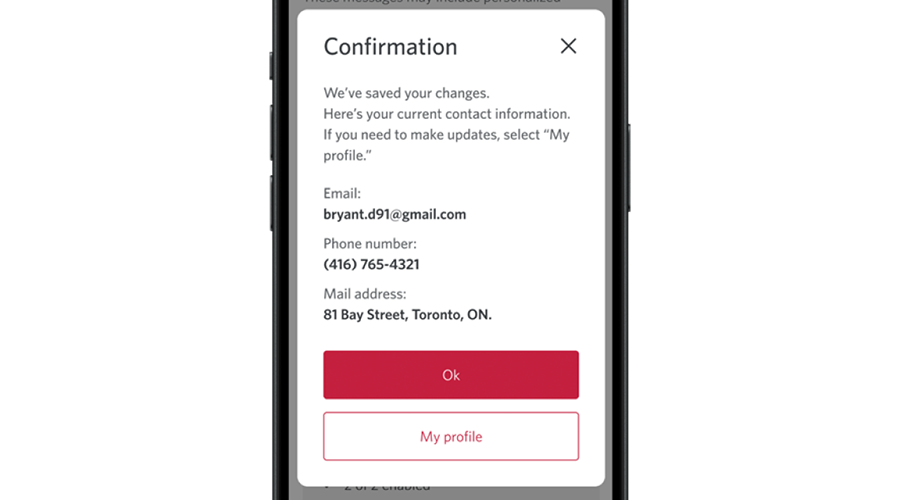

Step 7

Review your contact information and select “Ok” if everything is correct or select “My profile” to update your information.

Ready to manage your preferences?

Get started with mobile banking Skip to get started with mobile and online banking.

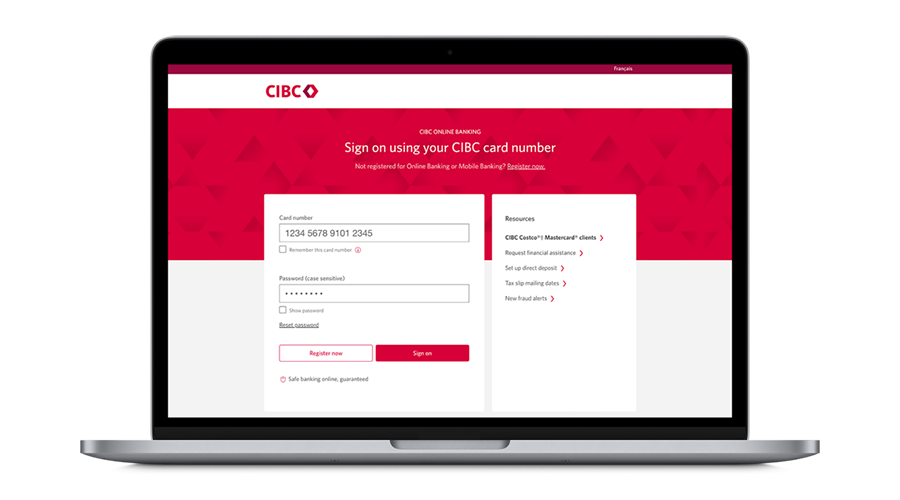

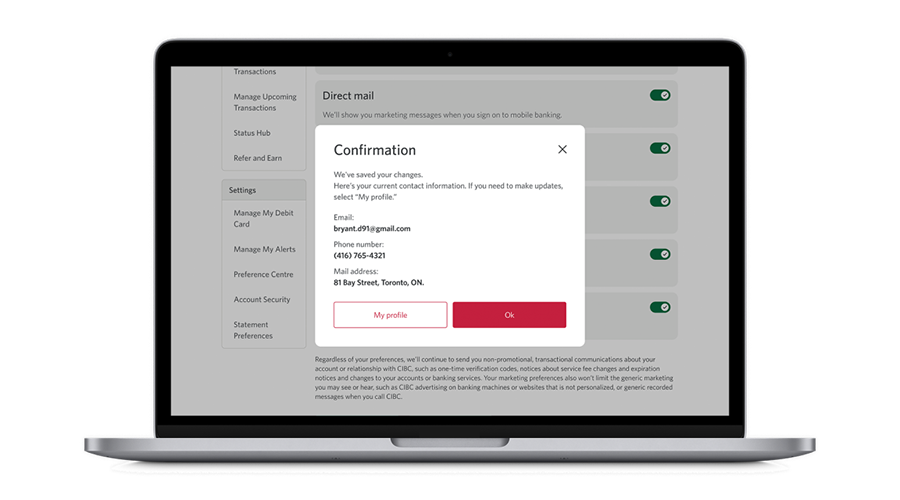

Manage your preferences through online banking

Step 1

Sign on to online banking.

Step 2

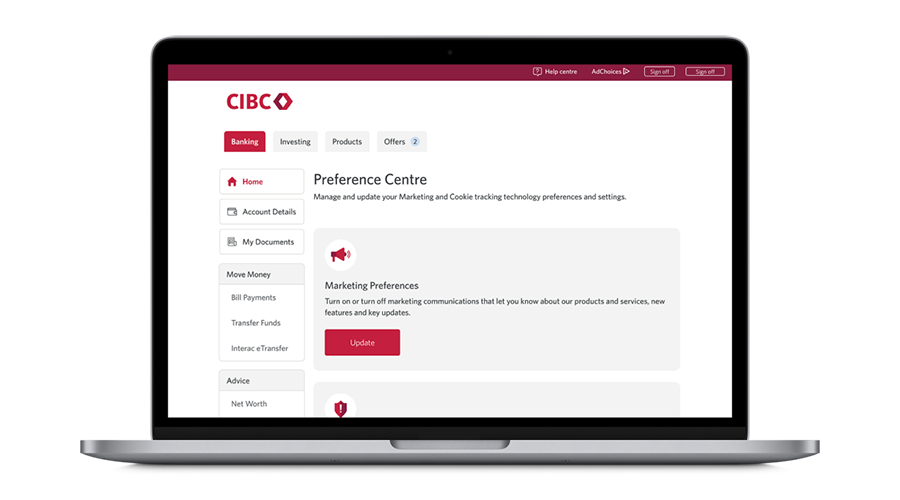

Select “Preference Centre” from the left menu bar.

Step 3

Navigate to “Marketing Preferences” and select “Update.”

Step 4

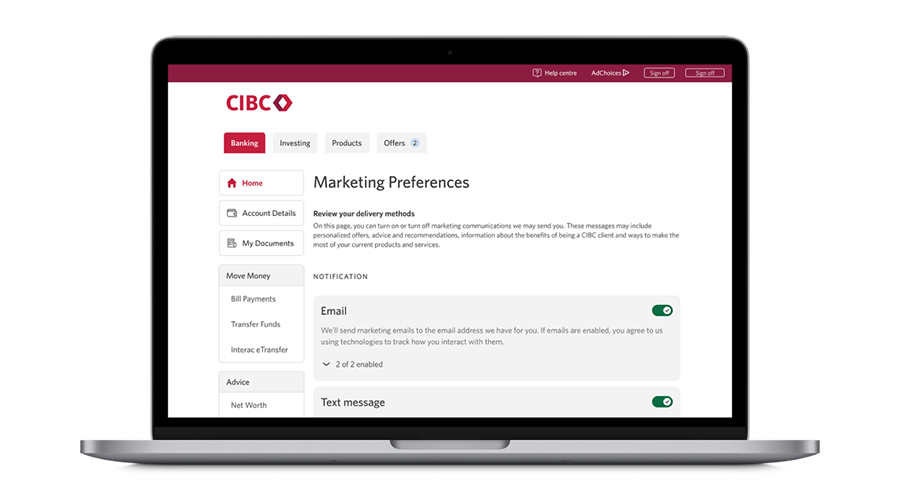

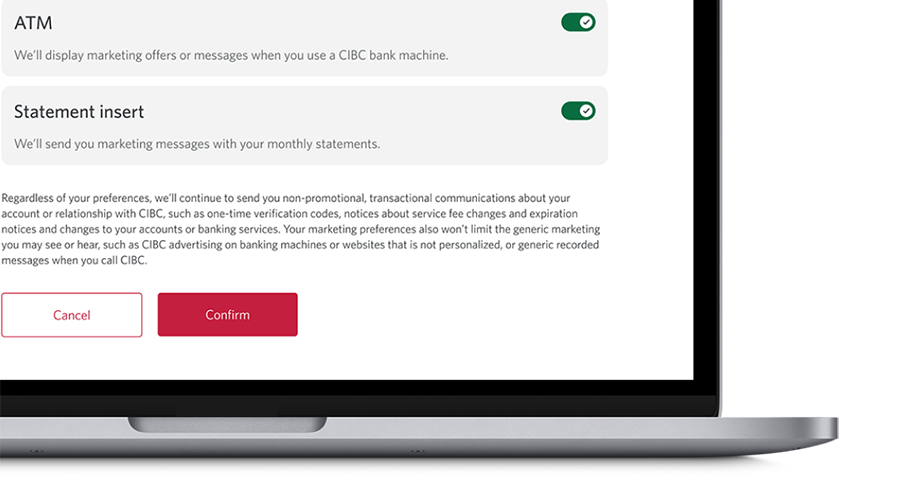

Review the different types of marketing communications and delivery methods and select the options you’d like to turn on or turn off.

Step 5

Select “Confirm” to save your choices.

Step 6

Review your contact information and select “Ok” if everything is correct or select “My profile” to update your information.

Ready to manage your preferences?

Sign on to online banking to get started Opens a new window.

Frequently asked questions

Learn more about digital banking

Set up account alerts

Get transaction and fraud alerts, payment reminders and more.

Switch to electronic statements

Review up to 7 years of your account eStatements through mobile or online banking.

Register for mobile and online banking Opens a new window.

Conveniently manage your everyday finances at any time.